In an era where institutional investors eye digital assets with equal measures of appetite and apprehension, Sygnum Bank has emerged as something of an anomaly—a fully regulated Swiss bank that treats Bitcoin custody with the same gravity as managing centuries-old family fortunes. The Zurich-based institution has now extended this peculiar marriage of tradition and innovation to SUI token services, creating what might be the most buttoned-up approach to blockchain assets the cryptocurrency world has ever witnessed.

Operating under FINMA’s watchful eye, Sygnum has accomplished something that would have seemed fantastical just a decade ago: transforming volatile digital tokens into instruments worthy of institutional balance sheets. Their SUI token integration exemplifies this transformation, offering family offices and asset managers a regulated pathway into what was once the exclusive domain of retail speculators and technologically adventurous hedge funds.

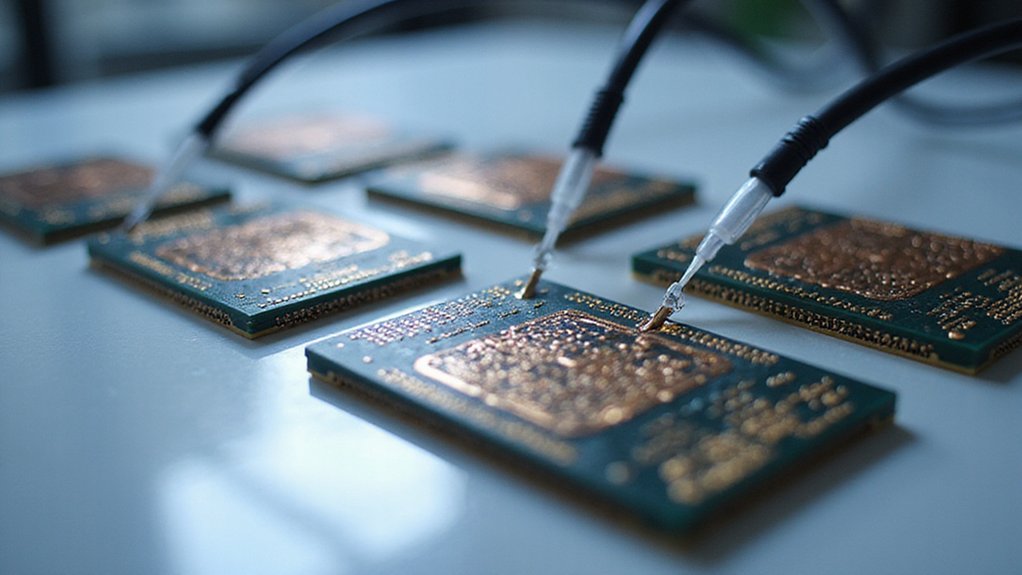

The bank’s multi-layer security protocols read like a paranoid’s handbook—cold storage, hardware security modules, and blockchain-based proof of custody tools that would make Fort Knox administrators nod approvingly. Yet this obsessive approach to security extends beyond mere technological safeguards.

Sygnum’s insured custody solutions protect against the kind of cyber risks that have turned other digital asset ventures into cautionary tales, while regular third-party audits provide the transparency that institutional clients demand (and regulators increasingly expect).

What distinguishes Sygnum’s approach isn’t merely regulatory compliance—though being Switzerland’s first digital asset bank to fully integrate AML and KYC standards into tokenized services certainly doesn’t hurt—but rather their systematic integration of digital assets into traditional banking infrastructure. Unlike centralized exchanges that generate revenue primarily through trading fees ranging from 0.1% to 0.5% per transaction, Sygnum’s model focuses on custody and institutional services under full regulatory oversight.

Real-time portfolio reporting, customized investment products, and seamless payment integration suggest that the bank views digital assets not as exotic alternatives but as inevitable components of modern financial architecture.

This positioning as Europe’s leading digital asset bank with full banking credentials represents more than institutional validation; it signals a fundamental shift in how regulated financial institutions perceive blockchain-based assets.