Cross-chain communication enables isolated blockchain networks to interact through bridge protocols that lock assets on one chain while minting equivalent tokens on another, effectively solving the fragmentation problem that decentralized technology inadvertently created. These systems use smart contracts and messaging protocols to facilitate trustless verification across incompatible architectures, transforming siloed ecosystems into interconnected financial networks—though security vulnerabilities have cost billions, creating a dependency paradox that challenges blockchain’s foundational trustless ethos while opening unprecedented opportunities for yield optimization.

The blockchain ecosystem’s greatest irony lies in its fragmentation—a technology designed to eliminate intermediaries has created countless isolated networks that cannot speak to one another. Cross-chain communication emerges as the solution to this self-imposed exile, enabling different blockchain networks to interact and exchange data or assets seamlessly across previously incompatible architectures.

This interoperability revolution addresses scalability bottlenecks that plague older blockchains while allowing users to leverage features and assets across multiple chains.

The mechanics involve sophisticated cross-chain bridges that lock or burn tokens on one network and mint or release equivalent assets on another—a digital sleight of hand that maintains asset integrity across disparate systems.

Messaging protocols facilitate trustless verification, while smart contracts automate these interactions with programmatic precision.

The economic implications extend far beyond mere technical convenience.

Cross-chain functionality increases liquidity by connecting previously isolated markets, transforming siloed ecosystems into interconnected financial networks.

Decentralized finance platforms exploit these bridges for asset swaps and lending protocols, while yield farmers maximize returns by harvesting opportunities across multiple blockchains (because why settle for modest gains on one chain when you can chase yields everywhere?).

However, this technological nirvana comes with considerable friction.

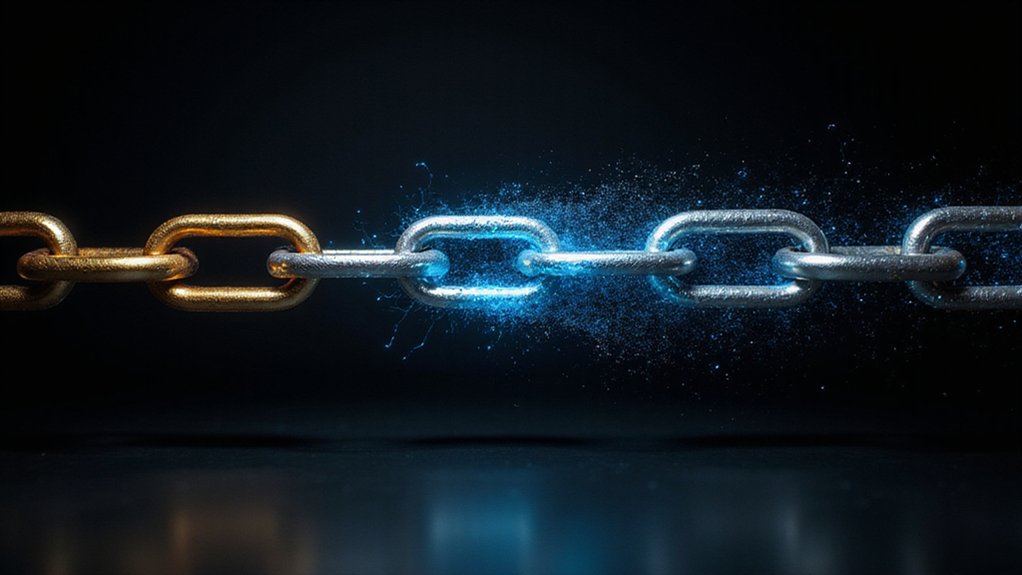

Different blockchain architectures create inherent complexity, while security vulnerabilities—particularly bridge hacks—have cost the ecosystem billions.

The reliance on third-party infrastructure introduces trust assumptions that somewhat contradict blockchain’s trustless ethos, creating a dependency paradox that developers continue grappling with. Advanced encryption techniques and multi-signature authentication provide additional layers of protection against these mounting security threats.

Notable applications span from NFT transfers between networks to multi-chain gaming platforms that leverage cross-platform assets.

Enterprise solutions utilize interoperability for supply chain verification and identity management, demonstrating utility beyond speculative trading.

The future trajectory points toward more sophisticated, generalized cross-chain protocols that promise enhanced security and broader functionality.

Projects like Chainlink’s Cross-Chain Interoperability Protocol represent attempts to standardize these interactions, potentially creating the infrastructure for a truly interconnected multi-chain ecosystem. These initiatives follow established standards similar to those developed by standards organizations to ensure seamless communication without data loss or misinterpretation.

Whether this vision materializes depends largely on resolving current security challenges while maintaining the decentralized principles that initially drove blockchain adoption—no small feat in an industry where innovation often outpaces prudent risk management.

Frequently Asked Questions

What Are the Main Security Risks When Using Cross-Chain Bridges?

Cross-chain bridges present formidable security vulnerabilities that would make traditional bankers blanch.

Smart contract flaws enable massive exploits (witness Wormhole’s $325 million debacle), while centralized architectures create irresistible single points of failure.

Inadequate multisignature schemes—as Ronin’s $600 million loss demonstrates—compound these risks.

Code vulnerabilities lurk despite rigorous auditing, and the bridges’ substantial asset pools make them perpetually attractive targets for sophisticated hackers seeking nine-figure paydays.

How Much Do Cross-Chain Transactions Typically Cost Compared to Single-Chain Transfers?

Cross-chain transactions typically cost substantially more than single-chain transfers, stacking fees from multiple networks plus bridge-specific charges.

While OP Mainnet recently recorded $13.9k in fees for large volumes and Arbitrum One hit $48.69k, cross-chain operations would combine both costs.

Single-chain transfers face only one gas fee, whereas cross-chain movements encounter unpredictable expenses from fluctuating destination network fees, bridge provider costs, and asset complexity—making cost estimation surprisingly challenging.

Which Cryptocurrencies Currently Support the Most Cross-Chain Communication Protocols?

Ethereum dominates cross-chain protocol support, serving as the anchor for Synapse, Defiway, Multichain, and Wormhole—a testimony to network effects in decentralized finance.

Binance Smart Chain and Polygon follow closely, benefiting from extensive bridge integrations across major protocols.

Solana, despite its non-EVM architecture, maintains robust cross-chain connectivity through dedicated bridges like Synapse’s Ethereum integration, while ISO 20022-compliant networks including Cardano and Algorand show emerging interoperability potential.

How Long Do Cross-Chain Transactions Usually Take to Complete?

Cross-chain transaction completion times vary dramatically, ranging from mere seconds to several hours depending on the underlying protocols and network conditions.

High-performance networks like Fantom and Avalanche can execute cross-chain transfers in under ten seconds, while traditional bridges involving Bitcoin or Ethereum might require 10-60 minutes for adequate security confirmations.

Network congestion, consensus mechanisms, and the particular interoperability solution employed all influence these timelines greatly.

Can Cross-Chain Communication Work Between Proof-Of-Work and Proof-Of-Stake Blockchains?

Cross-chain communication absolutely functions between PoW and PoS networks, though the consensus mechanism disparities create fascinating technical hurdles.

Protocols employ verification techniques—trusted committees, chain relays, or direct observation models—to bridge these architectural differences.

Smart contracts handle the heavy lifting of transaction validation across dissimilar networks.

While security risks multiply (naturally), the interoperability benefits prove compelling enough that developers persist in crafting increasingly sophisticated solutions for this computational diplomacy.