Innovation in Bitcoin mining has traditionally emerged from the shadows of Shenzhen manufacturing hubs and the engineering labs of established ASIC producers, but Block’s entry into the semiconductor fray represents a distinctly Silicon Valley approach to an industry that has grown comfortable with its oligopolistic tendencies.

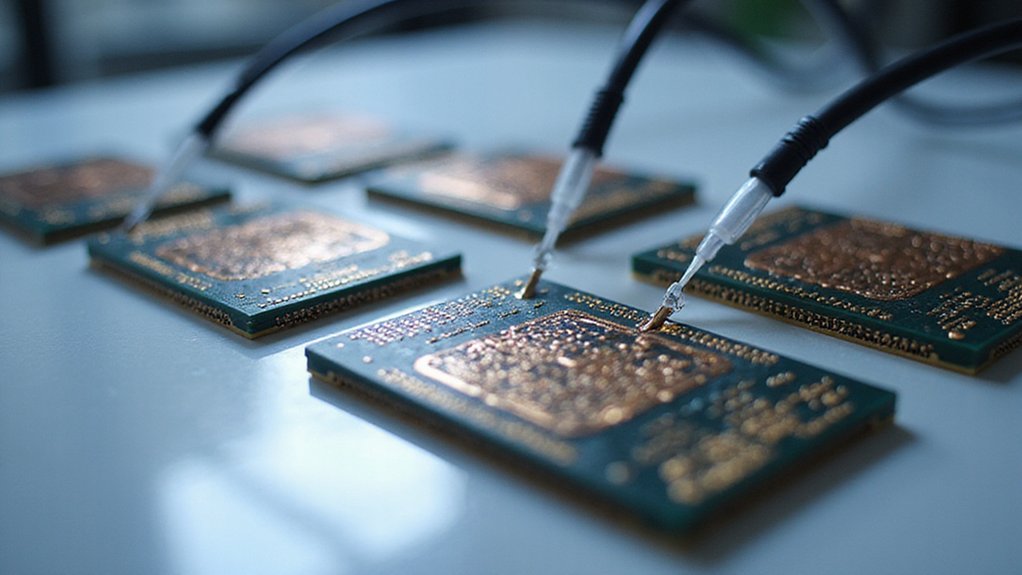

The company’s Proto team has developed mining chips using cutting-edge 3-nanometer semiconductor technology, targeting efficiency metrics that could surpass the 14-15 J/TH benchmarks expected from 2025 mining rigs. While Bitmain’s Antminer S21e XP Hyd 3U churns out 860 TH/s at 11,000W, Block’s approach emphasizes modular integration over brute force—a philosophical shift that prioritizes infrastructure compatibility alongside raw computational power.

Block’s modular integration philosophy prioritizes infrastructure compatibility over raw computational power, targeting efficiency metrics beyond traditional 2025 benchmarks.

The technical specifications suggest Block isn’t merely competing on hashrate density but reimagining how mining hardware integrates with existing data center infrastructure. Their 3nm process technology promises reduced power consumption while maintaining interoperability with legacy components, addressing sustainability concerns that have long plagued the industry. The anticipated 15 EH/s network contribution from large-scale deployments represents substantial hashrate supply, particularly given Block’s partnership with Core Scientific, North America’s prominent mining infrastructure provider.

What distinguishes Block’s strategy is its commitment to democratization through openness—soliciting feedback from both industrial-scale operators and home miners while potentially open-sourcing chip designs. This collaborative approach contrasts sharply with the proprietary ecosystems maintained by incumbent manufacturers, suggesting Block views mining hardware as a platform rather than merely a product. Intel’s earlier AXG Blockscale venture demonstrated how tech giants could achieve competitive performance with 256-chip chain systems reaching 148 TH/s, validating the potential for mainstream technology companies to challenge traditional mining hardware dominance.

The implications extend beyond technical specifications into market structure dynamics. A Silicon Valley entrant offering modular ASIC platforms could catalyze innovation similar to the open hardware movement in personal computing, potentially lowering barriers for independent miners and startups. The open ASIC design from Block could fundamentally transform home mining accessibility, enabling small startups and DIY builders to participate in ways previously impossible under proprietary chip ecosystems. Whether this translates into meaningful decentralization remains questionable, given the economic realities of mining scale requirements.

Block’s semiconductor venture aligns with broader corporate objectives around Bitcoin accessibility, though the gap between democratization rhetoric and mining economics reality persists. The company’s emphasis on community collaboration and hardware openness represents an intriguing departure from industry norms, potentially disrupting established manufacturing hegemonies while addressing long-standing criticisms about mining centralization and environmental impact. These infrastructure improvements could enable practical microtransactions that previously remained economically unfeasible for Bitcoin users.